Blogs

Theme Park Feasibility: What Investors Need to Know

Investing in a theme park is exciting, but it is also one of the most complex forms of development. Success depends on strategy, numbers, planning, and long-term vision. Before a single drawing is made or a site is purchased, the first step is understanding theme park feasibility. This process gives investors clarity, reduces risk, and reveals what kind of park will actually work in the chosen market.

This guide breaks down the feasibility essentials every investor should know before committing funds.

Understanding What “Feasibility” Really Means

Feasibility is not just a financial calculation. It is a full study of whether a theme park can survive, grow, and stay profitable in a specific environment.

A proper feasibility study examines:

- Market size and visitor demand

- Competition from other parks and entertainment venues

- Potential revenue streams

- Operational costs

- Land suitability and accessibility

- Local climate and seasonal behaviour

Investors use these insights to determine what kind of park makes sense — from a small adventure zone to a full-scale amusement park design.

1. Market Demand: The Real Foundation

Demand decides everything. Even the best-designed park cannot survive without enough visitors.

A demand assessment includes:

- Tourist footfall in the region

- Local population and family demographics

- Income levels and spending patterns

- Existing entertainment gaps

- School, college, and corporate outing potential

If the region cannot support high-ticket attractions, feasibility may shift the project toward a smaller, more compact entertainment model.

2. Selecting the Right Type of Park

Every idea is not suitable for every location. The feasibility process helps investors choose the right scale and theme.

Possible park formats:

- Indoor family entertainment centres

- Outdoor amusement parks

- Themed adventure zones

- Water parks

- Hybrid parks with mixed attractions

- Seasonal experience-based parks

Choosing the right format saves money and aligns expectations with market realities.

3. Financial Modelling: Turning Ideas Into Numbers

Investors must know the financial life of a park before building.

Key financial insights include:

- Expected footfall

- Average spending per visitor

- Construction cost estimates

- Staffing and maintenance expenses

- F&B and retail revenue potential

- Projected payback period

- Long-term operating risks

A reliable feasibility model helps investors evaluate whether the project meets their return expectations.

4. Location and Land Evaluation

The location can decide the success of the park.

Important factors:

- Highway and transit access

- Proximity to cities or tourist routes

- Land contour and soil conditions

- Flood risks and drainage

- Utility access (power, water, sewage)

Even the best amusement park design cannot compensate for poor connectivity.

5. Attraction Planning and Cost Logic

Every attraction has a different cost-to-value ratio. The feasibility study identifies which rides will deliver the highest engagement without overburdening the budget.

The process evaluates:

- High-impact rides vs. low-cost family attractions

- Indoor vs. outdoor activity balance

- Visitor age-group targeting

- Operational reliability

- Seasonal usage patterns

Successful parks offer a mix of attractions that appeal to multiple visitor groups.

6. Operational Feasibility and Staffing Needs

A park is only successful when it operates smoothly.

Operational feasibility includes:

- Staffing requirements

- Training and safety certifications

- Visitor flow modelling

- Maintenance schedules

- Technology integration

- Ticketing and queue systems

Understanding these early helps investors prepare for real-world operations.

7. Safety, Regulations, and Compliance

Investors often underestimate the cost and complexity of compliance.

Important considerations:

- Ride certifications

- Fire safety systems

- Crowd control planning

- Accessibility features

- Environmental permissions

- Annual inspections

Compliance affects timelines and budgeting, so feasibility must include regulatory evaluation.

8. Revenue Streams Beyond Tickets

Modern parks depend on multiple revenue channels to stay profitable.

Major revenue streams include:

- Food and beverage outlets

- Merchandise and theme retail

- Corporate events

- Birthday and group bookings

- Seasonal festivals

- Digital or VR add-ons

- Photo and media sales

A strong feasibility report shows how these streams can boost profitability.

9. Long-Term Sustainability and Growth Potential

A theme park should grow over time. Feasibility includes expansion planning.

Growth factors include:

- Additional zones or rides

- Seasonal festivals

- Night-time experiences

- IP-based attractions

- Hotel or resort integration

A park designed without expansion potential may face limitations after a few years.

Why Feasibility Determines the Future of Any Theme Park Project

With land, construction, and operational costs increasing, investors cannot rely on instinct alone. Theme park feasibility provides the clarity needed to make smarter decisions, optimize investments, and avoid expensive mistakes. It becomes the blueprint that aligns creative goals with market realities.

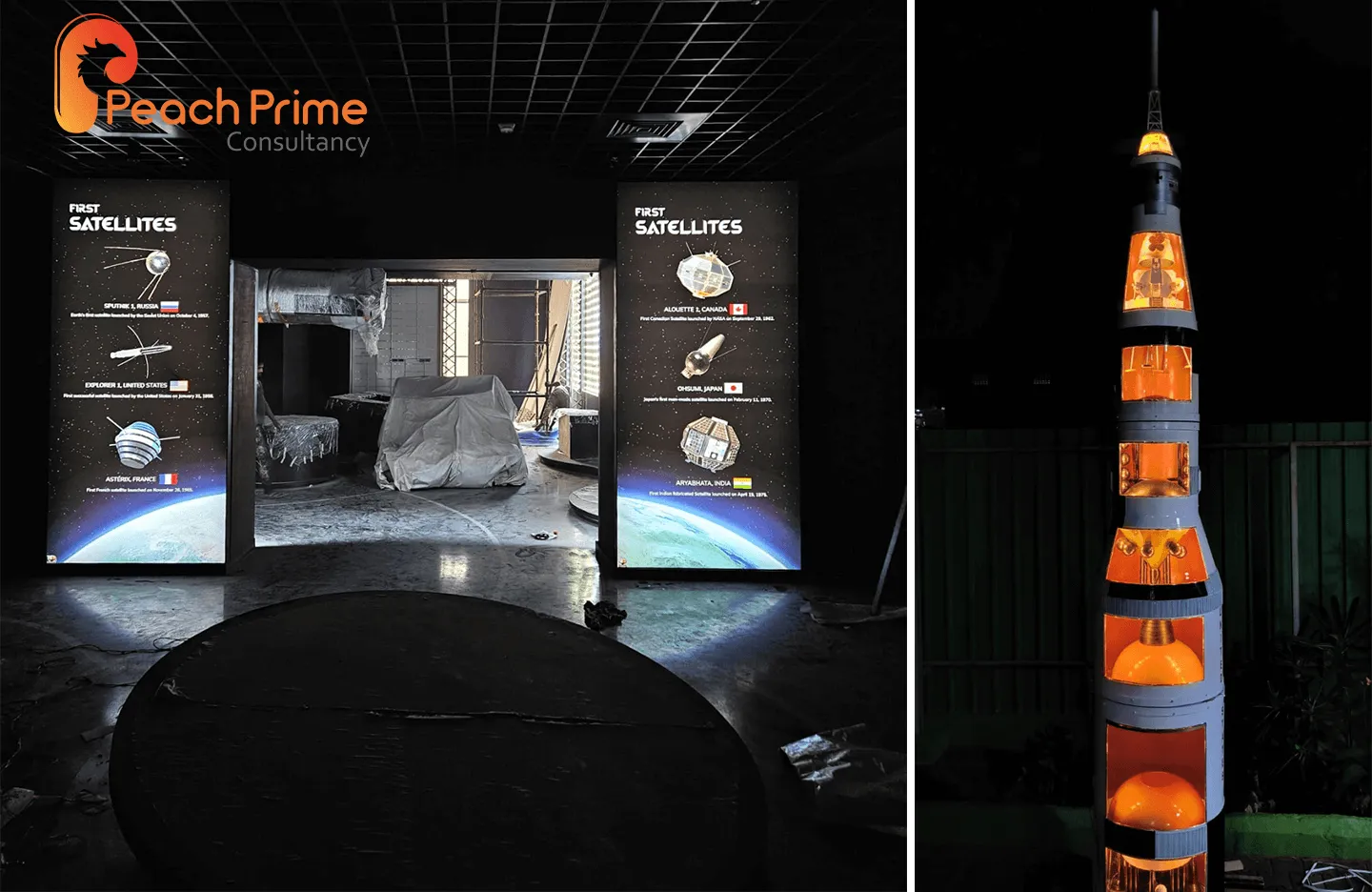

Peach Prime Consultancy: Your Partner for Feasibility-Led Park Development

Peach Prime Consultancy helps investors understand the real potential of their idea before development begins. The team combines data research, visitor behavior studies, location analysis, and cost modelling to build feasibility reports that guide successful amusement park design and development. By merging creative vision with realistic forecasting, Peach Prime ensures that every park concept is market-ready, financially sound, and designed for long-term growth. From evaluating land to planning experiences, Peach Prime supports investors at every step — helping them transform ideas into profitable, future-ready destinations.